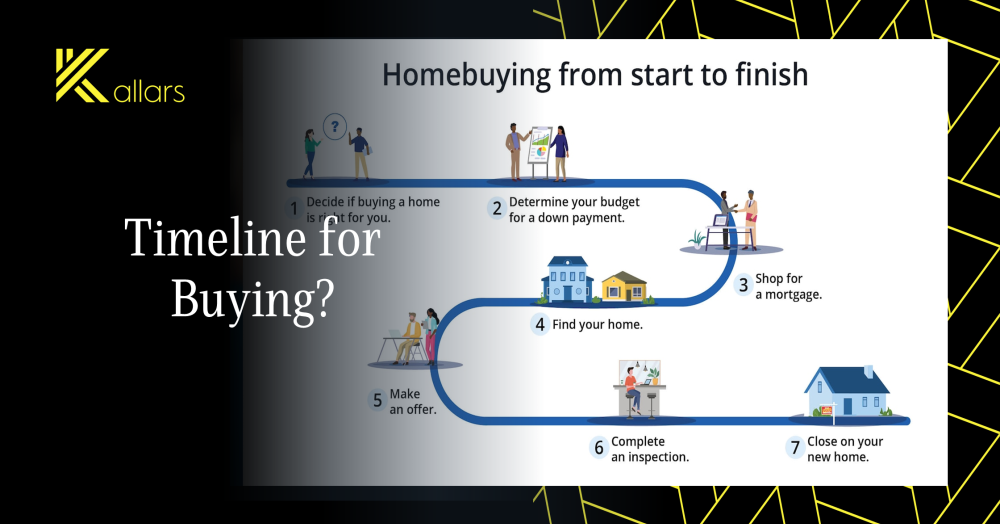

Buying your first home is exciting — but it can also feel like stepping into the unknown. One of the biggest questions new buyers have is: “How long does the whole process actually take?”

Yet most first-time buyers tell us the same thing: “I had no idea how long the process takes… or what to expect.”

With the right guidance, clear expectations, and a proactive team on your side, you can move from browsing online to holding your keys much faster than you think.

While every purchase is unique, most first-time buyers can expect the journey to take between 8 and 24 weeks, from starting your search to receiving the keys. Here’s a simple breakdown of what to expect at each stage — and how we help you speed things up.

Getting Mortgage-Ready (1–3 Weeks)

Before you even start viewing properties, you’ll want to get your finances in order. This usually includes:

- Checking your credit score

- Saving for a deposit

- Gathering documents (ID, payslips, bank statements)

- Getting a mortgage agreement in principle (AIP)

An AIP can often be done in a day or two, but preparing everything may take a little longer — especially if you’re new to the process

We help buyers get prepared by:

- Reviewing your credit position

- Ensuring your documents are correct the first time

- Securing a strong AIP within 24–48 hours in most cases

This stage is where many people get stuck — but with our support, you can get mortgage-ready quickly and confidently

Searching and Viewing Homes (2–8 Weeks)

This is the stage where timelines vary the most. Some buyers fall in love with the first home they see; others take weeks or even months to find “the one.”

Factors that affect this stage include:

- How specific are your requirements?

- Market conditions (busy markets move fast)

- Availability of suitable properties

- How often you’re able to attend viewings

What we do here: help you understand the market, refine your search, and move decisively when you find the right property.

Making an Offer and Getting Accepted (1–2 Weeks)

Once you’ve found a property you love, you’ll make an offer through the estate agent.

This part can be quick, but negotiations may go back and forth. You may need to:

- Adjust your offer

- Provide your AIP

- Prove your deposit funds

- Show you’re a serious buyer

We’ll help you present yourself as a well-prepared, motivated buyer — something estate agents love to see.

This can often make the difference between securing your dream home and losing it to another buyer.

Once accepted — congratulations! — You move into the legal and mortgage stages.

Conveyancing and Mortgage Processing (6–20 Weeks)

This is usually the longest part of the journey. It involves:

- Instructing a solicitor

- Property searches (local authority, drainage, environmental)

- Survey and valuation

- Mortgage application and approval

- Reviewing contracts

- Resolving any issues found along the way

Delays can come from slow searches, missing documents, mortgage underwriting, or legal questions about the property.

This is also where having the right support makes a huge difference — we chase progress, follow up, and keep communication flowing so your purchase doesn’t stall.

Tips to speed things up:

- Choose a proactive solicitor

- Respond quickly to requests

- Keep communication open with all parties

The timeline can be shorter or longer, depending on whether the property is freehold or leasehold. Any property falling under the Building Safety Act can take in the region of 4 months, with the extra compliance needed via your solicitor.

Exchanging Contracts (1 Week)

Once the legal work is complete and your mortgage is approved, you’ll exchange contracts. This is when the sale becomes legally binding.

You’ll agree on a completion date at this point — usually 1–3 weeks later.

This is the moment everything comes together..

Completion Day — You Get the Keys!

On completion day, the funds are transferred to the seller and the estate agent hands over the keys. Time to celebrate and move in!

So, What’s the Total Time?

Most first-time buyers take between 2–6 months from starting their search to moving in.

However, it can be faster — or longer — depending on the market and how smoothly the legal and mortgage stages go.

Final Tips for First-Time Buyers

- Get your finances sorted early

- Stay organised with paperwork

- Choose your solicitor and mortgage broker carefully

- Be prepared for some waiting around

- Ask questions — no question is too small

Want to Make Your First Home Purchase Faster, Smoother, and Less Stressful?

If you want expert guidance, clear communication, and someone who keeps the process moving, book a call with us today.

We’ll help you understand your options, your timeline, and the best next steps for your situation.

👉 Ready to get started? Let’s talk.